Identity Verification Solutions

KYC Australia is a trusted service provider that specializes in delivering comprehensive and globally available identity verification services. They prioritize utilizing cutting-edge biometric technologies to ensure the accuracy and credibility of customer databases. With a focus on strict identification verification protocols, their data banks and sources include identity data from challenging yet crucial countries.

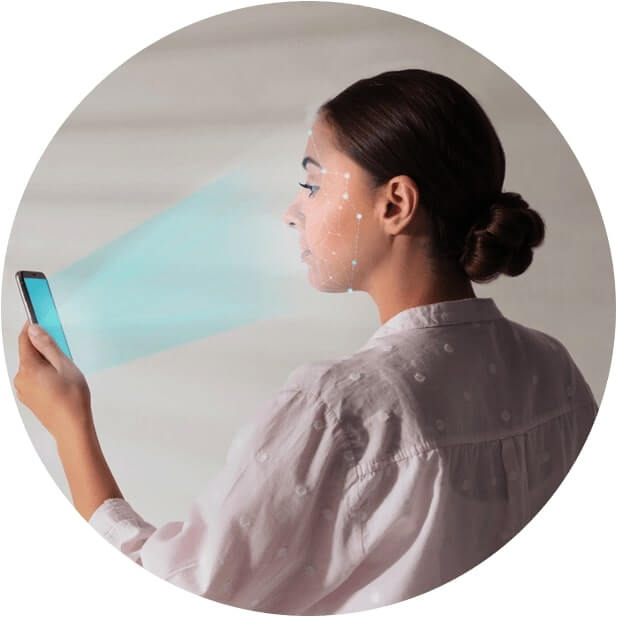

The proprietary identity verification service programming interface (API) developed by KYC Australia leverages advanced biometric technologies to meticulously examine customer identity documents. This process guarantees that each user is precisely who they claim to be. The aim is to provide businesses operating in Australia and beyond with unparalleled identity verification services tailored to their specific needs. KYC Australia's sophisticated identity verification system not only validates user identities but also ensures a seamless, fast, and secure verification process. By implementing industry-leading expertise and cutting-edge technologies, KYC Australia has established itself as a reliable provider in the field of identity verification. Their services can be trusted by clients who possess intermediate knowledge of identity verification services.

Overall, KYC Australia remains dedicated to offering exceptional identity verification services to businesses worldwide. Their commitment to accuracy, efficiency, and security makes them a top choice for businesses seeking reliable identity verification solutions.

Know Your Customer (KYC) Solutions

KYC Australia recognizes the significance of accurate customer identity verification and offers a range of solutions to address key issues within the KYC process. The regulations introduced in 2001 under the Patriot Act have laid the foundation for KYC requirements, including customer identification, activity analysis, and the assessment of money laundering risks. To establish a complete digital eKYC process, businesses need to develop a Customer Identification Program (CIP) and maintain Customer Due Diligence (CDD). The CIP ensures that customers' identities are verified through appropriate documentation and verification methods, while the CDD involves ongoing monitoring of customer activity to identify and mitigate potential risks.

KYC Australia also offers customizable KYC platform solutions that can be tailored to meet the unique needs of businesses in Australia and beyond. These solutions provide a reliable, efficient, and cost-effective way to manage the KYC process while remaining compliant with regulatory requirements. By partnering with KYC Australia, businesses can benefit from their expertise and industry knowledge, ensuring that their KYC processes are robust, reliable, and efficient. This allows businesses to operate with confidence, knowing that they are adhering to KYC regulations and effectively managing customer identification and risk assessment.

Video Know Your Customer (KYC) Solutions

The KYC Australia Platform offers video-based verification, enabling secure and trusted customer onboarding. This service uses AI technology, biometrics, and liveness detection to enhance the legitimacy and efficiency of the verification process. Additionally, live agents can interact with customers in real-time and provide an additional layer of human oversight. This combination of AI technology and live agent support helps prevent fraudulent activities and ensures the integrity of the customer onboarding process. Additionally, businesses can achieve compliance with regulatory requirements, expand their reach, and reduce operational costs through remote customer onboarding.

ID Verification Solutions

KYC Australia presents ID Verification, an advanced application that verifies and authorizes customer identity documents like passports, ensuring protection against identity fraud. This solution is a vital component of KYC Australia's identity fraud prevention suite, designed to detect and thwart fraudulent activities proactively. With ID Verification, businesses can authenticate government-issued identity documents from over 175 countries, both online and offline. These include passports, driver's licenses, and national IDs. The application seamlessly integrates with anti-money laundering solutions, enabling quick customer validation in just six seconds through a user-friendly API. Moreover, it excels at authenticating various identity documents, including national IDs, driver's licenses, passports, and utility bills. By leveraging the power of our ID verification solutions, companies can ensure compliance and experience significant improvements in conversion rates, offering reassurance that their customers' identities are accurately verified.

Age Verification Solutions

In the current business environment, ensuring age verification plays a vital role in protecting against underage customers and deterring fraudulent activities. Validating the age of customers not only helps reduce legal and financial liabilities but also safeguards businesses from potential damage to their reputation. Industries such as alcohol, tobacco, adult-only establishments, and restricted access commerce vendors particularly benefit from implementing age verification processes. By implementing efficient Know Your Customer (KYC) practices, companies can avoid significant financial penalties resulting from negligence and maintain a positive brand image. Embracing age verification measures enables businesses to effectively manage risks and ensure compliance with regulatory requirements.

KYC Australia Age Verification Solutions offer a comprehensive range of identity verification solutions that facilitate global age verification. These solutions leverage official data sources from around the world to assist companies in verifying the age of their consumers, thereby minimizing financial, legal, and reputational risks. One such solution is IDMkyc, a verification product that utilizes an API to swiftly and accurately authenticate personal identities. It offers numerous benefits, including fraud and risk management, customer age verification, compliance with KYC and Anti-Money Laundering (AML) regulations, accelerated customer account approvals, prevention of identity theft, and fostering enhanced trust with regulatory entities

Anti-Money Laundering Solutions

KYC Australia offers Enhanced Due Diligence as part of its services, which aids in the detection of individuals with malicious intent and ensures compliance with ongoing regulations. Additionally, KYC Australia provides real-time risk mitigation by granting users access to a vast global database containing information on more than 15 million bad actors and politically exposed individuals (PEPs). Through the utilization of KYC Australia's AML Monitoring Screening Software, customers can undergo screening against global watchlists, while the Anti-Money Laundering Solutions provided help minimize the risks associated with money laundering and other illicit activities. Leveraging advanced technology, KYC Australia facilitates the identification of high-risk profiles, matching customers against over 1200 Sanctions Lists, and monitoring potential risks associated with customers' profiles.

Know Your Business (KYB) Verification Solutions

Know Your Business is an exceptional service designed to verify essential corporate information, helping businesses prevent fraud. Our business verification services offer the highest match rates in the industry, ensuring compliance with KYB regulations, enhancing existing compliance programs, enabling swift onboarding of new business customers, nurturing long-term business partnerships, providing access to unique Beneficial Owners (UBOs) and business addresses, and strictly adhering to the most rigorous encryption and security standards required by law. With our service, businesses can enjoy a streamlined onboarding experience without the need for any human interaction.

- Forge enduring business relationships through KYB.

- Establish long-lasting business alliances with KYB.

- Cultivate enduring business partnerships with KYB.

Gain Access To:

- Identification Numbers for Companies.

- Dates of Company Formation.

- Title of the Business.

Client Onboarding | Seamless Customer Onboarding

KYC Australia specializes in facilitating customer onboarding for organizations, enabling them to effectively engage and convert customers. By prioritizing the customer experience, a well-executed onboarding program can foster and establish enduring relationships. To avoid customer abandonment, banks and financial institutions must ensure adherence to KYC and AML protocols, while also streamlining the process for a seamless onboarding experience. Allocating resources to enhance the customer experience can amplify brand confidence, boost revenue, and minimize abandonment rates.

PEP and ASO Verification

The enforcement of laws restricting transactions and asset freezes within Australia falls under the jurisdiction of the Australian sanctions office (ASO), a branch established by DFAT. This division oversees the implementation of several acts, such as the Trading with the Enemy Act, the International Emergency Economic Powers Act, and the Foreign Narcotics Kingpin Designation Act. According to the Financial Action Task Force (FATF), politically exposed persons (PEPs) are individuals who hold significant public positions, whether domestically or internationally. The level of risk associated with PEPs depends on various factors, including the extent of their influence, the magnitude of monetary involvement, and the prevalence of corruption and money laundering in their respective countries. It is crucial to conduct PEP checks before establishing a business relationship and to regularly monitor existing clients. The KYC Australia identity verification solution can assist in identifying whether an individual is a PEP, thereby streamlining the compliance process.

Customer Due Diligence | Behavior Monitoring Solutions

KYC Australia provides a user-friendly system for behavioral biometrics, a form of biometric technology that identifies distinctive behavior patterns associated with individuals. This technology is gaining popularity among financial institutions for customer authentication due to its user-friendly nature and ability to enhance account security.

When combined with other security solutions, behavioral monitoring empowers businesses to strengthen their security measures and identify criminals who might have evaded other security protocols. This not only aids in fraud prevention but also mitigates potential risks to the business.

By incorporating KYC Australia's behavioral biometrics and other security solutions, businesses can ensure a heightened level of safeguarding for their customers' accounts and data. This fosters customer trust and elevates the business's reputation.